Breaking News : Stand a chance to win an Ipad Air when you like us on our facebook page and join us to become our member by filling the membership form at the bottom, you will receive latest updates from us through email , facebook and also being added into our investment education Telegram group !

Technical Analysis

IN Big Picture GUOCO land is under institutional investors radar screen and I am not caught in surprise this stock been purchased by them ... I am look at the macro level the wave starts with the Cycle wave degree followed by the primary and Intermediate wave degree... it very important to look at the overall big trend for the stock before I am committed to zoom down further in.

Pls look at the chart below, the small chart is the major trend for GUOCO, basically it indicate this stock have many wave degree pointing to north. I zoom in to the recent uptrend which is Dec'2013 till today, basically you can see it is an extension 3/C.

This pattern has been define as a trend pattern in which wave 3 is extended, it is the most probable trend pattern to occur, very often the wave 1 length is equal to wave 4 in time and prices.

Current status:

Most probable wave 4 is ended at the fibo 23.8%, base on my observation wave 4 is ending in between Fibo 23.8 to 38.2%, if wave 4 is ended at 23.8%, we should see a fast acceleration to go north soon.

Let zoom it down to H1 chart, the downtrend channel line been broken and now the prices is sit above the line, the short term downtrend been invalidate, sideways or wave 5 uptrend is should under developing now.

Fundamental Analysis from Kenanga.

War chest of landbanks.

The group has a remaining total

landbank of c.9,300 ac, of which 51% is in Sepang, 41% in Jasin, Melaka, 6% in

Rawang and balance are niche parcels, which are mostly located in prime areas

in Klang Valley (e.g. KLCC, Gombak, Sg Buloh, etc). This under researched

group’s landbank size is not too far behind UEMS of c.12,000 ac and more than

IJMLAND’s c.6,000 ac while its landbanks are mostly located in Klang Valley. We

think that Guocoland’s current market cap of RM1.2b is unjustified when

compared to IJMLAND’s RM5.2b and UEMS’s RM9.4b. Notably, the bulk of its

landbank was acquired in the 1990s and early 2000, which would imply low land

cost. Recently, the group also increased its stake in one of their JCE which

owns 3,869 ac of landbank in Jasin, Melaka (refer overleaf).

3-year pipeline GDV of RM2.5b,

which was recently

highlighted in The Edge, comprising: (i) landed residential project at Emerald

@ Rawang project, (ii) township development at Pantai Sepang Putra @ Sepang,

(iii) high-end landed residential at Alam Damai @ Cheras, (iv) 28 factory units

at PJ City Commercial Hub, and (v) portions of Damansara City. Positively, it

appears that a substantial amount of projects are geared towards landed

residentials or industrials, which should fare well in terms of sales.

Damansara City (GDV: RM2.5b)

will benefit from upcoming MRT station.

The project is located next to

Pusat Damansara and directly fronts the upcoming MRT station. The group is in

the midst of selling its DC Residency. We also do not discount Guocoland

selling its completed offices via en bloc sales or securing JV investors. Note

that the group also has a 21.7% stake in Tower REIT that invests in

offices, and is the manager of the REIT; this could be an avenue for asset

realization as well. (Refer overleaf).

Under heat from UMA query. Last

week, Bursa issued a UMA query. Guocoland’s share price had shot up 50% within

a 5-day trading period with heavy daily trading volumes. The company has

reverted to Bursa stating they are unaware of any reasons for such strong price

performance. Based on our analysis of previous the stock movements which have

experienced UMA this year, we gather that from the date of UMA, the quantum of

correction is between 11% to 18% and the correction period will last 16 – 50

days before bottoming out.

Projecting FY14E and FY15E core

profits of RM49.3m (+43% YoY) and RM65.6m (+33% YoY). 9M14

core earnings grew by 47% YoY to RM40.9m driven mainly by margin expansions

from its property divisions. Our FY14 estimates are based on annualized 9M14

figures. FY15 should be driven by stronger property sales of RM640m from PJ

City, DC Residency, Emerald and its Sepang project (refer overleaf).

An under-researched

counter. The stock has a very volatile

3-year historical PER range of 11x-138x (average: 30x) while its PBV range is

0.7x-1.3x (average: 0.9x). We believe there is a mismatch in terms of the

company’s asset value and their speed of RNAV realization. However, in view of

better earnings prospects via unlocking of landbanks in the near future, we

expect its PERs to narrow the gap with its peers.

An RNAV play. Primarily,

our RNAV is driven by revaluation on its landbank, investment property and

inventory value to market prices. Only DC’s project is valued based on DCF of

its future profits. Thus, our valuations are conservative as we are opting for

land-driven RNAVs rather than assuming full development value of each

landbanks. We derive an RNAV of RM5.89 and assume a steep 50% discount (higher

than our average discount applied on developers of 31%) to derive a TP

of RM2.95. We recommend that investors buy on weakness as we strongly

believe that Guocoland is severely undervalued. Trading BUY.

Source: Kenanga

http://klse.i3investor.com/blogs/kenangaresearch/57218.jsp

http://klse.i3investor.com/servlets/staticfile/244437.jsp

My trading partner research:

GuocoLand (Malaysia) Bhd has an established presence of over 50

years in property development, management and investment in Malaysia. The

company is also part of the Singapore-based GuocoLand Ltd. The multi-award

winning GuocoLand is a leading regional property plater with established

operations in China, Malaysia, Singapore and Vietnam.

GuocoLand Malaysia's property project include the Emerald master

planned township in Rawang and prime residential and commercial developments in

Klang valley. These include Commerce One, PJ City Corporate Hub and the soon to

be launched Damansara City.

GuocoLand Malaysia is also active in property investment via Tower

Real Estate Investment Trust (Tower REIT) and has in its portfolio high quality

and yield-accretive office buildings (Menara HLA, Menara ING and HP Towers) in

KL. It also owns Thistle Johor Bahru and Thistle Port Dickson Resort.

GuocoLand vision is to create a prominent and sustainable property

group in Malaysia. Guocoland's landbank totals 10,000 acres comprising 5,000 in

Sepang, 4,000 in Jasin, Melaka and pockets of land in the Klang Valley.

The RM2.5 billion GDV Damansara City is scheduled to be fully

completed by mid-2016, ahead of the mass rapid transit (MRT) Sungai

Buloh-Semantan line which is set to be operational before the end of 2016. This

flagship development at Damansara City, is being sold at RM1,600 per square

foot and comprises 370 units of one to four bedrooms contemporary design homes

as well a penthouse.

All the current GuocoLand's developments which encompasses a

shopping mall, will provide a substantial recurring income base for the

company.

GUOCO 5 Years Revenue & Profit Trend

source:http://www.malaysiastock.biz/

GUOCO Quarter Report History

Recent company

activities:

Massive hiring to cope recent development projects

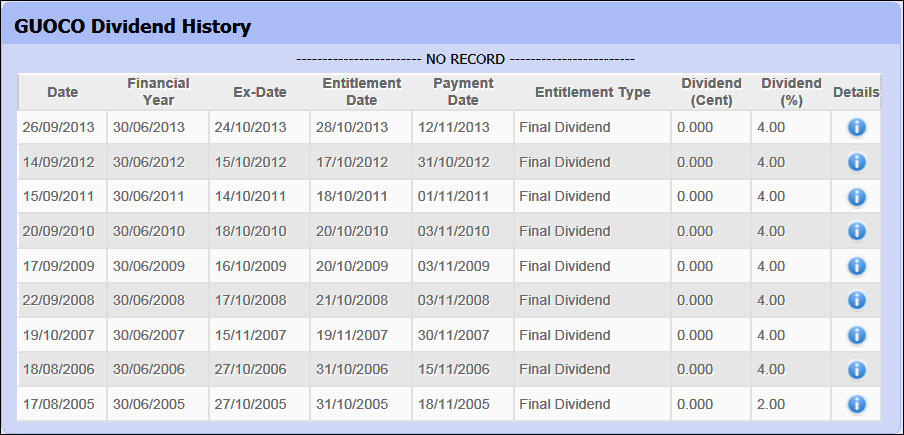

High profit but flat dividend paid over the years,

what's next?

Rumors:

Guocoland's landbank are all undervalue.

My trading plan as below

Buy at 1.82

1st TP : 2,00

2nd TP :2:20

Med Term : 2.80

Long Tern : 4.20

Stop Loss : 2 candle close below 1:75 early

Stop Loss : 2 candle close Below 1:35 late

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

No comments:

Post a Comment