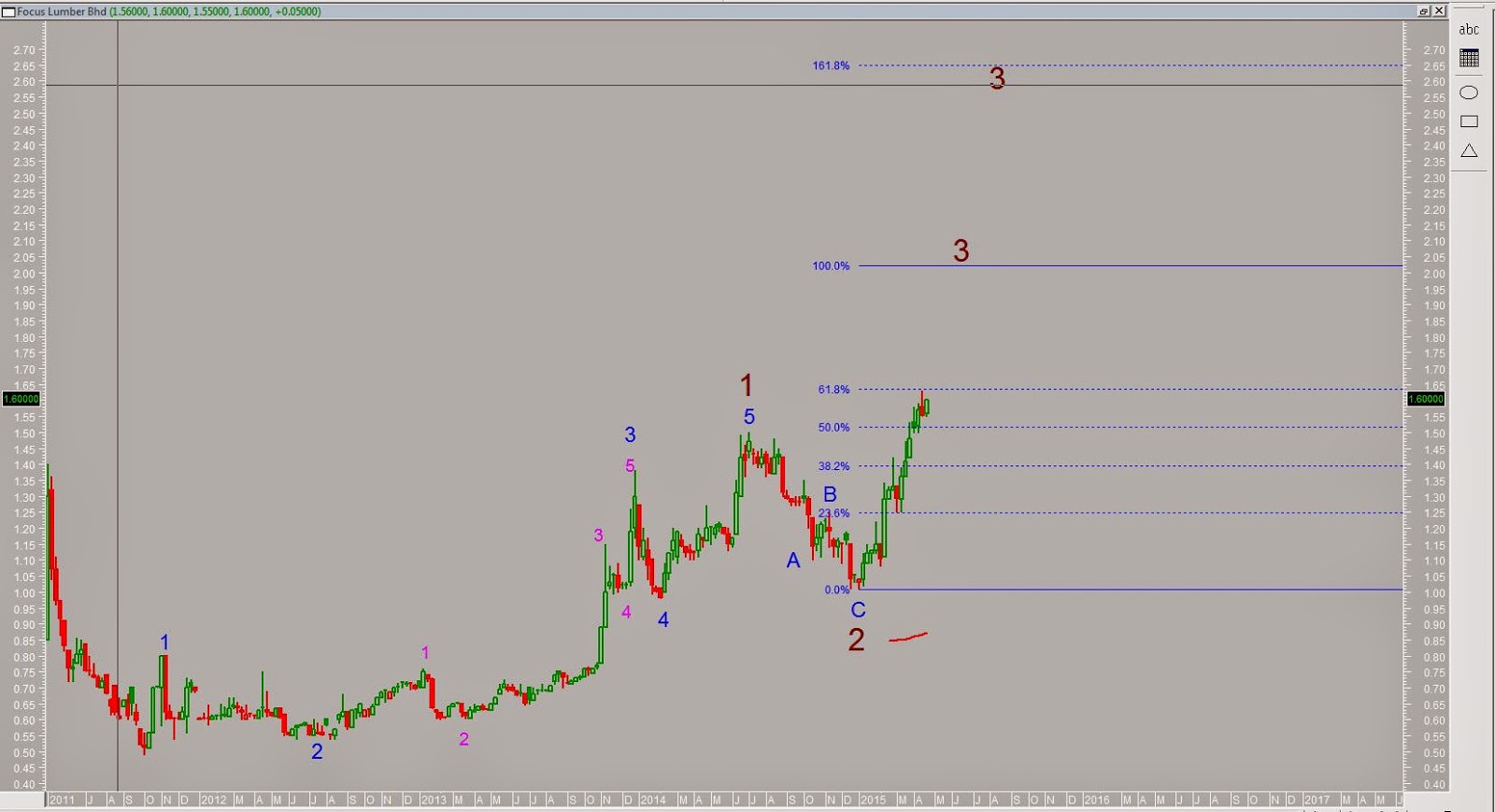

Immediate support : $1.50

Strong Support : $1.40

Strong Support : $1.36

Profit target is : $1.68/$1.74/$1.90.

Stop loss is < $1.40/$1.36

Action : Long/buy, 5 wave degrees uptrend

Type signal : BREAK OUT,conservative

Applies to : Insitutional investors

Conservative Target:1.93

2nd Target :2.41

Wave degree (1st) :Cycle

Wave :3

Wave degree (2nd) :Primary

Wave :3

Late Exit Alert :1.2500

Earlier Exit Alert :1.3600[trading]

Action : Long/buy, 5 wave degrees uptrend

Type signal : BREAK OUT,conservative

Applies to : Long term investors

Conservative Target 1.68

2nd Target :1.93

Wave degree (1st) :Primary

Wave :3

Wave degree (2nd) :Intermediate

Wave :3

Late Exit Alert :1.3600

Earlier Exit Alert :1.3600[trading]

Action : Long/buy, 5(!) wave degrees uptrend

Type signal : BREAK OUT,conservative

Applies to : Institutional traders

Conservative Target 1.67

2nd Target :1.68

Wave degree (1st) :Intermediate

Wave :3

Wave degree (2nd) :Minor

Late Exit Alert :1.3600

Earlier Exit Alert :1.3600

CLICKS HERE FOR INFO TO JOIN AS Y-PREMIUM MEMBER

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

CLICKS HERE FOR INFO TO JOIN AS Y-PREMIUM MEMBER

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.