Wednesday, December 30, 2015

Tuesday, December 29, 2015

London Biscuts Bhd(7066) Bullish signature Was Showed

Executive Summary

Uptrend formation clearly showed and we can find an evident of the formation of high, higher high and low, higher low. On top of that, RSI, MACD and Stoch show bullish bias. Immediate support was found at the recent round bottom formation at $0.810/$0.815, I am looking in to collecting this stock near the immediate support if see weakness. because I am anticipating this stock likely to test $0.885/$0.910, Successfully break above it will move stock to $1.00/1.07. I will stop loss if end of day close $0.785.

Technical Justification- Bullish Bias

Triangle breakout- Correction change to uptrend

Uptrend Channel

Technical Indicator

Elliot Wave

If you have any question: pls email me at klseta88@gmail.com

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Sunday, December 20, 2015

Symlife(1538): Now is good price level to chip in !!! Expect to reach $0.910/$1.00

Executive Summary

It's immediate support was found at $0.755/$0.750( the statement was supported by long lower shadow doji/hammer formation) and bottom was found at $0.690. I am anticipating prices going move up to target of $0.900/$1.00 very soon as results of Symmetrical Triangle pattern may breakout away from $0.820 and heading to test $0.845. A break above $0.845 it is out of its long term consolidation to start stage 2 of the new cycle(4 stages Market analysis), in this case, Elliott wave 3 kicked in which is the longest and strongest wave and heading to target of $1.00. I will scale in more when the breakout happen and price go beyond $0.845. Any weakness toward $0.750 is offer opportunity to collect ! I will Stop loss if price go below $0.740( end of Day).SYMLIFE NTA is $2.12

Current prices us $0.820 and I believed it is good deal to bought a property worth $2.12 !!

Technical Justification

Left hand side(LHS)/Right Hand Side(RHS) Trading

It is one of the trading Methodology I used to spot market reversal up trend, refer to the chart above, we can see the commonality and characteristic of this counter trend change from LHS(down trend) to RHS (uptrend) will happen after it break the Tom Demark trend-line. I am making conclusion recent LHS(downtrend) was ended and bottom was found at $0.690 and LHS(uptrend) was kick in, target of the LHS is range from $1.25/$1.35.

Elliott Wave Trading

Weekly trend, the worse is over and major correction on wave 2 was ended with double Zig Zag (WXYXZ) and bottom was found at $0.690( on Sept/30/2015). New wave cycle was started and wave 1 reach $0.845(Nov/09/2015) follow by wave 2 correction and immediate support found at $0.755/$0.750( the statement was supported by long lower shadow doji/hammer formation). we are riding on initial stage of wave 3 and it heading to $1.00.

Chart Pattern Trading.

It has formed a Symmetrical Triangle pattern which usually followed by a continuation of its preceding trend, which for the case of Symlife is UP.It is now trading inside its Triangle from $0.76 to $0.82.The recent consolidation is with reduced volume, which is very healthy.I anticipate it will try to breakout from $0.82( downtrend resistance of the Triangle) to $0.845. A break above $0.845 it is out of its long term consolidation to start stage 2 of the new cycle, which is very bullish and carry an estimated target of $1.00 if resistance of $0.90 can be taken out. Stop Loss if $0.76 is violated that mean it break down from the Triangle which turns bearish.( Analysis from Matrixcool).

Indicator Analysis

1.) RSI stay above 50 and swing up to indicate bull ran kicking in2.) MACD golden cross above 0, it is indicate bull trend is resume after consolidation.

3.) Stochastic Oscillator signal line cross and indicate uptrend is coming.

Candle stick analysis

Immediate support found at $0.755/$0.750, the statement was supported by long lower shadow doji/hammer formation.

--------------------------------------------------------------------------------------------------------------------------

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Thursday, December 17, 2015

It is the time to demonstrate Bull Power !!! Yong Tai bhd heading to $0.870/$0.970/$1.07

Executive summary

Corrective wave 4 was ended and bottom was found at $0.630, this was validated by recent rally when price reach $0.795. Right after that, corrective wave take place ad price down to $0.710 which was formed inverted right shoulder bottom, 3 green candles rally were build complete inverted head and shoulder on today(12/17/15) !!! ! It is a strong evident of extended wave 5 is under development and I am anticipating it should test $0.800 soon !!! breakaway from $0.795 will build and confirm Elliott wave 3(immediate wave count) kick in and heading to $0.875/$0.970/$1.17. Along the way to the target, we should face resistance of 0.830/$0.880/$1.00.I will lock partial profit and apply trailing stop along the resistance line. my Stop loss is $<0.700( end of day)

Technical justification:

Wave 3 of 3 of 3 is on going

Tt is very bullish wave count and apply to aggressive trader/investors, because retracement of wave 2 is just complete and wave 3 just kick start, it will declare 3 consecutive wave 3 confirm when price go beyond $0.890, when this happen normally prices will accelerate up and many traders will join the ride to take advantage of the ride.Extended wave 5 kick in

Wave 4 correction was over and extended wave 5 is forming !!! In the wave 4 internal structure we can see it formed a inverted head and shoulder ! It is an evident to indicate extended wave 5 is under development. target for wave 5 will be $0.875/$0.970KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Wednesday, December 16, 2015

Sedania: 3rd try to break downtrend line !!!

Executive summary

Sedania: 3rd attempt to break downtrend trend line since 2nd of DEC, today close right at the downtrend trend line at $0.430, I am anticipate it should breakaway and test next resistance line at $0.445/$0.470/$0.495/$0.520. my stop loss is below $0.365KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Tuesday, December 15, 2015

KTC : Fundamental Outlook

Kim Teck

Cheong Consolidated Berhad (KTC)

KTC was

recently listed in ACE market in second half of November 2015. The IPO price

was 15 sen.

Prospects

·

Embarking

major expansion in Sabah, Sarawak and Brunei with the intention to list in main

board in 2 years timeframe, expansions include expanding warehouse facilities

in Sabah, Sarawak and Brunei and purchasing 3 new bakery production line.

·

In FYE

30th June 2015 sales into Sarawak account for mere 4.51%, combining

the expanded warehouse and relatively untapped market, Sarawak will be the key

driver to KTC’s increase in sales revenue and profitability.

·

Most

of the expansion will materialize in FH of 2016, therefore contribution from

the expansion likely will only contribute in June 2016 onwards.

·

Projected

revenue and gross profit from the expansion are expected to increase KTC

revenue to RM400m - RM450m by FYE 30th June 2017 base on the

following :-

o

New

warehouse facility in Kota Kinabalu will increase around 38% of its current

capacity in Kota Kinabalu.

o

Larger

warehouse facilities in Sarawak, (Miri, Sibu & Kuching) will increase

around 77% its current capacity.

o

Adding

3 new production lines to manufacture new bakery products with the expected

capacity of 40,000 pieces per day will double its current production and

effectively doubling revenue as well.

·

Basis

14% gross profit margin, RM400m – RM450m revenue will yield RM56m to RM63m

gross profit margin while its profit after tax will be in the region of RM12m –

RM13.5m.

Monday, December 7, 2015

EITA Resource Bhd: New high is on the way of making !!!

Executive Summary

Double bottom formed and immediate bottom was found at $1.10 in weekly chart, three white solders break neckline at $1.35 on this week and heading to test $1.55, break away from it will form wave 3 which is most strongest and longest uptrend wave in Elliot wave Theory. I am anticipate likely it will test $1.65/$1.74/$2.00/$2.35.My Trading plan

I am trade and also invest in this stock.My stop loss for trading position is is <$1.35

My stop loss for investment position is <1.10.

I will lock profit and apply trailing stop along the $1.65/$1.74/$2.00/$2.35.

KLSE Technical Analysis Stock Forum

I has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Tuesday, December 1, 2015

EG (8907) – DEEPER INTO THE NUMBERS

Due to the numerous queries on EG’s latest Quarterly Report (QR) with some expressing concern over its latest results, we thought we address some of the concerns here.

EG’s latest QR registered a 1.45% drop in its revenue over the corresponding 2015 QR report with a 31% drop in Profit before tax. It does paint an under performance result for the company that is disappointing. However, a quick glean over its Annual Report for the financial year of 2015 revealed that there was a spike in EBITDA and Profit Before Tax suggesting an extraordinary source of income. Dissecting further into its financial results, we can see that there were more than meets the eye.

EG did highlight the cause of this drop under note B1 in the Notes to the Interim Financial Report. There was a gain on disposal of other investments of RM6.7m in Q1 of 2015. This is an extraordinary gain that projected a big decrease in profits before tax when we compare Q1 2015 to Q1 2016, i.e. from RM7.76m to the current RM5.34m. When we remove this extraordinary gain from the equation, EG’s results painted a very different landscape.

Net Profit Before Tax:

Q1 2015 (‘000) = RM7,759

Q1 2016 (‘000) = RM5,338

Profits Decreased by 31%

Net Profit Before Tax after removing the extraordinary gains:

Q1 2015 (‘000) = RM1,059

Q1 2016 (‘000) = RM5,338

Profits Increased by 404%, an approximate growth of 5 times

To highlight the growth trend of EG, the company took the extra effort in comparing the Q1 2015 to the preceding Q4 2015 and we can see that there was a healthy growth in both Revenue and Profits before Tax of 25.5% and 30.5% respectively.

This is a very impressive performance during challenging times against a backdrop of a fluid volatile environment, politically and economically, both internally and externally.

Historically, EG has been registering an average basic EPS of 2.68 sen from 2011 to 2014 before the EPS spike in 2015 of 35.39 sen. The EPS in the just released QR of 6.56 sen was calculated based on its shareholding base of 76.8m, before accounting for its rights issue. Re-calculating its basic EPS after adjusting for its enlarged shareholding base of 192m would yield an EPS of 2.6 sen.

This means that EG is maintaining its average EPS of pre 2015. It has embarked on growth strategies to enhance its bottom line by changing its product mix to increase revenue contributions from its box build segment. The box build segment moves EG up the value chain which implicitly enhances its profits margin. Thus, its successful contract for new orders for box-build products worth RM150m announced yesterday augurs well for the company and reinforces the company’s direction and growth path. It is also testimony to the good management and foresight of the company.

It is also worth noting the entrance of 2 key shareholders in 2015 into the top 10 list of the largest shareholders in EG, namely Mr Koon Yew Yin and Mr Fong Siling aka Coldeye. Investors are well aware that the presence of these key shareholders indirectly is a vote of confidence into the future of the company.

All in all, EG is well on track in its growth strategies and the future of the company looks bright. Its successful transition of up scaling in the value chain would potentially improve its future profit margins. So, to our members who were concerned about the fundamentals of the company, we believe that EG remains a good stock with no deterioration in its financial standing.

From a TA perspective, its uptrend remains intact although it did show some short term weakness. It currently enjoys good support at 0.81/0.82 with an immediate resistance at 0.88.

Source: Jay from TCB

Saturday, November 21, 2015

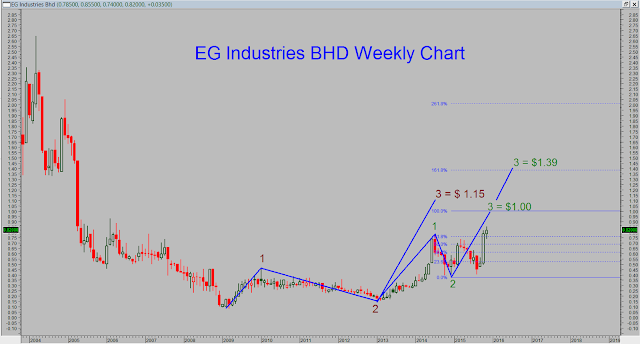

EG Industries Bhd Declared Superbull Run!!! Weekly trend breakaway and heading to $1.00/$1.15/$1.39 !!!

Executive Summary

Prices was breakaway from the weekly resistance at $0.780 and stay above it in 3 consecutive weeks, this is an evident wave 3 formation was confirm ! most likely price will heading to target of $1.00/$1.15/$1.39 near future. Daily chart is showed wave 3 development in progress which is heading to target of $0.910/$0.950 and possible of $1.00. I do anticipate daily chart triangle breakout just around the corner !!! which will bring the price toward target of $0.930/$1.00.My trading plan:

I bought in EG on Friday because 4 consecutive(weekly+daily) positive wave degree is showed uptrend, I am anticipate daily pattern will break pennant formation to the target of $1.00/$1.15/$1.39, I will locking partial profit, apply trailing stop and trading along the target and support resistance line. My final target is $1.39. Any weakness toward $0.800/$0.790 is offer me buying opportunity. I will cut loss if price drop below $0.740Technical Justification

Elliot wave : Weekly Chart formed 2 consecutive wave 3, it was confirm break away from the wave 2 flat formation, this is very bullish implication was wave 3 is most strongest and longer uptrend in Elliott wave theory,Wave 2 flat formation

Daily Chart :I discover two alternate wave most likely will happen !!

1st Alternate is wave 3 development is ongoing, target is $0.910.

2nd Alternate count is extended wave 5, internal structure is wave 2 correction end and wave 3 kick start, once price go beyond $0.855, extended wave 5 is confirmed wave3 confirmation, target us $1.13

Chart Pattern trading

Daily chart is formed triangle break above 0.835 will break price move to $0.930/ $1.00Support Resistance

Immediate support is $0.800 and strong support at $0.790/$0.745.Immediate Resistance at $0.840/$0.890/$0.90/$1.00/$1.20.

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Sunday, November 15, 2015

ESCERAM: Contracting triangle breakout !!! heading to test $0.550/$0.570/$0.600/$0.650

Executive Summary.

Price with volume breakout on 27th of Oct '15 which was an indication of buying interest increased, but profit taking was take place on following day, it was enable correction kick in and most likely ended on 11/Nov/15. New uptrend(wave 3/3/5/3/3) were developed and start on 12/Nov/15, which is break away from triangle formation, I am anticipate likely it should test strong resistance at $0.550, break above it will bring price to $0.570/$0.600/$0.650 and possible of $0.780. Immediate support is at $0.475/$0.445. I will take the loss if prices close below $0.475 because it is 1st indication of weakness. Prices close below $0.445 need reassessment on the wave count.

Technical Justification

Elliot wave

Wave 3/3/5/3/3 is overall wave structure, the mail wave degree is Wave 5/3/3 which is showed at the technical chat below and the target for the wave structure is ($0.500/$0.600)/ ($0.780/$0.570)/ $0.650.

Let unfold the smaller wave degree wave 3/3/5/3/3, it is wave 3 of 3 in the wave 5 internal wave structure .

Chart Pattern

Triangle formation breakout just happen and it should heading to the $0.610

I did Wave count on Escream March this year pls check the link at below

http://klse.i3investor.com/blogs/KLSETA/72970.jsp

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

DISCLAIMER:

Price with volume breakout on 27th of Oct '15 which was an indication of buying interest increased, but profit taking was take place on following day, it was enable correction kick in and most likely ended on 11/Nov/15. New uptrend(wave 3/3/5/3/3) were developed and start on 12/Nov/15, which is break away from triangle formation, I am anticipate likely it should test strong resistance at $0.550, break above it will bring price to $0.570/$0.600/$0.650 and possible of $0.780. Immediate support is at $0.475/$0.445. I will take the loss if prices close below $0.475 because it is 1st indication of weakness. Prices close below $0.445 need reassessment on the wave count.

Technical Justification

Elliot wave

Wave 3/3/5/3/3 is overall wave structure, the mail wave degree is Wave 5/3/3 which is showed at the technical chat below and the target for the wave structure is ($0.500/$0.600)/ ($0.780/$0.570)/ $0.650.

Let unfold the smaller wave degree wave 3/3/5/3/3, it is wave 3 of 3 in the wave 5 internal wave structure .

Chart Pattern

Triangle formation breakout just happen and it should heading to the $0.610

I did Wave count on Escream March this year pls check the link at below

http://klse.i3investor.com/blogs/KLSETA/72970.jsp

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Saturday, November 7, 2015

HOMERIZ: Insitutional investors/ Long term investors/ Institutional traders is on the boat !!!

Executive Summary

Wave 4/2 correction down was ended and bottom found at $1,07, it was validated by hidden bullish divergent decouple with RSI/Stochastic swing up at 50 and below 20 level respectively, Last week Wednesday/Thursday Wave 1(Minute/Minuette wave degree) was kick in with optimize volume, it is an indication of Position/Future trader were on board, Friday profit taking kick in which developed wave 2 correction and I anticipate wave 3/5 will kick in very soon move the stock $1.22/1.28/$1.43. I will collect more stock on weakness near immediate support at $1.12/$1.09 . I will lock partial profit and apply trailing stop along the resistance line at $1.19/$1.23. My Stop loss is Close below $1,07.

Elliot Wave

Institutional Investors

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This is a very long term signal for institutional investors since it starts with the Cycle wave degree followed by the primary and Intermediate wave degrees. The target of the Intermediate wave degree, which is in wave 2, is the most conservative target to reach at 1.42 or percentagewise 25.7%

Long term investors

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This signal applies to long term investors for price moves of possibly 30% or more, since Primary, Intermediate and Minor Wave degrees are all up. The most certain price target is the target of the Minor wave degree, which is in wave 2, at 1.39 or percentagewise 23.8%.

Normally also the target of the next wave degree could be reached at 1.42, which is in wave 2

Institutional Traders.

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

A price move of in general 10% or more is indicated, depending on how far the price move has progressed already, which is interesting to institutional traders.

From Intermediate to Minute Wave degrees the trends are all up. Most likely the target of the Minute wave degree, which is in wave 2, will be reached at 1.22 or percentagewise 8.00%.

Normally also the target of the next wave degree could be reached at 1.39, which is in wave 2.

I am typical retail trader and I ask myself after look at the Elliot wave count !!! What are you waiting for? by looking at the chart I will take advantage of the upswing to trade along the way up.

Action :I buy, 5 wave degrees uptrend

Type signal : BREAK OUT, Conservative

Applies to : Institutional investors

Conservative Target :1.68

2nd Target :1.85

Wave degree (1st) :Cycle

Wave :3

Wave degree (2nd) :Primary

Wave :3

Late Exit Alert :0.85

Earlier Exit Alert :0.85

Action :I buy, 5(!) wave degrees uptrend

Type signal : RETRACE, aggressive

Applies to : Long term investors

Conservative Target :1.4212

2nd Target :1.6879

Wave degree (1st) :Primary

Wave :3

Wave degree (2nd) :Intermediate

Wave :2

Late Exit Alert :0.85

Earlier Exit Alert :1.00

Action : Long/buy, 5(!) wave degrees uptrend

Type signal : RETRACE, agressive

Applies to : Institutional traders

Conservative Target :1.39

2nd Target :1.42

Wave degree (1st) :Intermediate

Wave :2

Wave degree (2nd) :Minor

Wave :2

Late Exit Alert :1.00

Earlier Exit Alert :1.07

Above stop loss is apply to end of days candle close below the Exit Alert.

Technical Indicator

1. Substantial volume kick in to start wave 1, it is early sign of uptrend

2.RSI swing up above 50% and Strong bull trend continuality signal

3.MACD golden cross about to happen and it is signal of trend reversal

4.Stochastic cross up below 20% is very bullish reversal up

5.Hidden trend continuous bullish divergent to indicate bottom been found and upward will continue bull ran

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Regards

Jason Wong

DISCLAIMER:

Wave 4/2 correction down was ended and bottom found at $1,07, it was validated by hidden bullish divergent decouple with RSI/Stochastic swing up at 50 and below 20 level respectively, Last week Wednesday/Thursday Wave 1(Minute/Minuette wave degree) was kick in with optimize volume, it is an indication of Position/Future trader were on board, Friday profit taking kick in which developed wave 2 correction and I anticipate wave 3/5 will kick in very soon move the stock $1.22/1.28/$1.43. I will collect more stock on weakness near immediate support at $1.12/$1.09 . I will lock partial profit and apply trailing stop along the resistance line at $1.19/$1.23. My Stop loss is Close below $1,07.

Elliot Wave

Institutional Investors

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This is a very long term signal for institutional investors since it starts with the Cycle wave degree followed by the primary and Intermediate wave degrees. The target of the Intermediate wave degree, which is in wave 2, is the most conservative target to reach at 1.42 or percentagewise 25.7%

Long term investors

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This signal applies to long term investors for price moves of possibly 30% or more, since Primary, Intermediate and Minor Wave degrees are all up. The most certain price target is the target of the Minor wave degree, which is in wave 2, at 1.39 or percentagewise 23.8%.

Normally also the target of the next wave degree could be reached at 1.42, which is in wave 2

Institutional Traders.

This is a very positive signal! Now even 5 consecutive wave degrees show a clear POSITIVE trend, as well as a positive EASI, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

A price move of in general 10% or more is indicated, depending on how far the price move has progressed already, which is interesting to institutional traders.

From Intermediate to Minute Wave degrees the trends are all up. Most likely the target of the Minute wave degree, which is in wave 2, will be reached at 1.22 or percentagewise 8.00%.

Normally also the target of the next wave degree could be reached at 1.39, which is in wave 2.

I am typical retail trader and I ask myself after look at the Elliot wave count !!! What are you waiting for? by looking at the chart I will take advantage of the upswing to trade along the way up.

Action :I buy, 5 wave degrees uptrend

Type signal : BREAK OUT, Conservative

Applies to : Institutional investors

Conservative Target :1.68

2nd Target :1.85

Wave degree (1st) :Cycle

Wave :3

Wave degree (2nd) :Primary

Wave :3

Late Exit Alert :0.85

Earlier Exit Alert :0.85

Action :I buy, 5(!) wave degrees uptrend

Type signal : RETRACE, aggressive

Applies to : Long term investors

Conservative Target :1.4212

2nd Target :1.6879

Wave degree (1st) :Primary

Wave :3

Wave degree (2nd) :Intermediate

Wave :2

Late Exit Alert :0.85

Earlier Exit Alert :1.00

Action : Long/buy, 5(!) wave degrees uptrend

Type signal : RETRACE, agressive

Applies to : Institutional traders

Conservative Target :1.39

2nd Target :1.42

Wave degree (1st) :Intermediate

Wave :2

Wave degree (2nd) :Minor

Wave :2

Late Exit Alert :1.00

Earlier Exit Alert :1.07

Above stop loss is apply to end of days candle close below the Exit Alert.

Technical Indicator

1. Substantial volume kick in to start wave 1, it is early sign of uptrend

2.RSI swing up above 50% and Strong bull trend continuality signal

3.MACD golden cross about to happen and it is signal of trend reversal

4.Stochastic cross up below 20% is very bullish reversal up

5.Hidden trend continuous bullish divergent to indicate bottom been found and upward will continue bull ran

KLSE Technical Analysis Stock Forum

Jason has launched KLSE Technical Analysis on Telegram Channel as an avenue to disseminate stock & financial markets news; Technical analysis and give members real time update on my trade plan. KLSE Technical Analysis on Telegram Channel will also ease my burden from multiple postings to numerous chatting groups on Telegram, All the groups will remain & continue to be chatting groups as they are now.

To JOIN you need to install telegram either on your mobile phone or desktop.

Aniways Messenger can’t access Telegram Channel. Click the link below to join.

Click the link below to join the KLSE Technical Analysis on Telegram Channel

https://telegram.me/KLSETA

Regards

Jason Wong

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Monday, November 2, 2015

Priva: Bullish signal were showed ! It is good time to buy up ???

Executive summary

This is a very positive signal! What are you waiting for? Now even 5 consecutive wave degrees show a clear POSITIVE trend, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This signal applies to long term investors for price moves of possibly 30% or more, since Primary, Intermediate and Minor Wave degrees are all up. The most certain price target is the target of the Minor wave degree, which is in wave 3, at 0.3005 or percentage wise 7.3%.

Normally also the target of the next wave degree could be reached at 0.320/0.350, which is in wave 3.

Chart Pattern trading is showed invert head and shoulder is forming and price was gap up and i anticipate it will creeping about to the neckline at $0.300, break above the neck line will bring price to target of $0.350

Below is trade set up and trading plan apply to various type of investor/traders for my own reference

DISCLAIMER:

This is a very positive signal! What are you waiting for? Now even 5 consecutive wave degrees show a clear POSITIVE trend, which indicates that the target has not yet been reached. More and more wave degrees showing a positive trend increases the probability of strong acceleration!

This signal applies to long term investors for price moves of possibly 30% or more, since Primary, Intermediate and Minor Wave degrees are all up. The most certain price target is the target of the Minor wave degree, which is in wave 3, at 0.3005 or percentage wise 7.3%.

Normally also the target of the next wave degree could be reached at 0.320/0.350, which is in wave 3.

Chart Pattern trading is showed invert head and shoulder is forming and price was gap up and i anticipate it will creeping about to the neckline at $0.300, break above the neck line will bring price to target of $0.350

Below is trade set up and trading plan apply to various type of investor/traders for my own reference

Trading Challenge

Many people committed to buy stock is very easy, when come to profit taking and cut loss is one of the most difficult part in trading world, talking about profit taking is dealing with greed and stop loss is dealing with fear, cutting loss is a must in trading world because it stopping my capital continue to loss, in order to stay alive in trading world... it is a must !!! it is not an option, else I suggest you get out of the trading and you are not suitable.

I wanted to used simple example to share on the cut loss ... you bought an egg and prepare to used it for fry rice, some how you notice/suspect the eggs you pick was/may turn bad.... the question now is shall out throw/scrap the bad one and pick another .... or nevermind bet or hope the suspicious "bad" egg will be good and risk the good rice which is ready to cook ? you make the call... I am believed in order to win I got to know how to prevent I am loss in the market... if I notice I am wrong... I got to admit and cut the loss and make a next move.

As a reminder for myself

I am always remind myself If the trend is go again me and violated my SL limit, I will cut loss base on the risk preference.

Stop Loss is painful process because I making loss, but it is necessary to take it, it is very important because it protect my capital to ensure I am stay in the market.

DISCLAIMER:

Stock analysis and comments presented on klseelwavetrading.blogspot.com are solely for education purpose only. They do not represent the opinions of klseelwavetrading.blogspot.com on whether to buy, sell or hold shares of a particular stock.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.